Information Disclosure Based on TCFD Recommendations

Our Support for TCFD Recommendations

In response to the global shift towards decarbonization in recent years, the NOK Group has expressed its support for the recommendations of the TCFD (Task Force on Climate-related Financial Disclosures) established by the Financial Stability Board (FSB) in April 2022. The NOK Group has been advancing efforts related to climate change under its environmental vision "NOK Twin Green Plan 2030" leading up to 2030, and intends to further strengthen these efforts in light of its support for the TCFD. Going forward, we will continue to identify, based on TCFD recommendations, the risks to and opportunities for our business activities posed by climate change, reflect our findings in our business strategies, and proactively disclose information to enhance our corporate value.

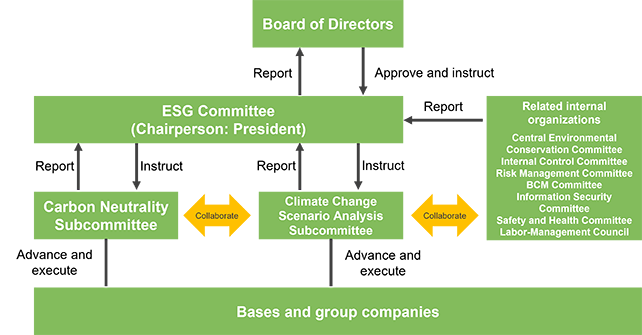

Governance

The NOK Group has established an ESG Committee under its Board of Directors as an organization responsible for formulating various management policies, including our climate change actions based on medium- to long-term perspectives. The ESG Committee, chaired by the President and composed of general managers from different divisions, is responsible for formulating NOK's environmental, social, and governance-related policies and targets, and for checking our progress toward these targets. The ESG Committee has been set up such that initiatives discussed at the Committee are subject to review by the Board of Directors. In addition, the Climate Change Scenario Analysis Subcommittee and the Carbon Neutrality Subcommittee have been established under the ESG Committee as specialized bodies for climate change actions. The Climate Change Scenario Analysis Subcommittee estimates the potential impacts of climate change, while the Carbon Neutrality Subcommittee formulates and promotes specific climate change actions. These subcommittees take the lead and work with related internal organizations, bases, and group companies to promote climate change initiatives, and regularly report on the progress of these initiatives at ESG Committee meetings.

Risk Management

NOK has established its basic policies and management regimes for group-wide risk management in its Risk Management Regulations. Based on these regulations, we have established a management regime for promoting risk management of the Group where the President takes charge of risk management. Climate change-related risks and opportunities are assessed and managed by the ESG Committee. The Climate Change Scenario Analysis Subcommittee, which is a subordinate body, works with the Risk Management Committee and other relevant internal organizations to identify and classify climate change risks and opportunities based on their magnitude and duration of impact on business operations. These results are submitted to the ESG Committee for assessment and deliberation, after which they are reflected in discussions on actions and business strategies. Significant risks and opportunities are reported regularly to the Board of Directors.

Strategy

We recognize that climate change is an important management issue that will affect our finances into the future. As such, we have carried out scenario analyses in accordance with TCFD recommendations in order to assess the impacts of climate change and reflect climate change actions in our management strategy. Based on data from sources such as the International Energy Agency (IEA), we assessed the impact of climate change on our businesses under two scenarios, the 4°C and 2°C scenarios. Based on the results of these scenario analyses, we will be reviewing and promoting actions to address the identified risks and opportunities as outlined below. We will also continue to expand our scenario analyses and incorporate their results into our business strategies and management plans in order to improve the resilience of our management strategy.

Scenario Definition

- Period covered: 2030

- Scope of coverage: NOK Consolidated Global

- Referenced scenarios: IEA WEO (Stated Policies Scenario, Sustainable Development Scenario), RCP2.6, RCP4.5, RCP6.0, RCP8.5, etc.

| Envisioned world | 4°C scenario | 2°C scenario |

|---|---|---|

| Temperature rise |

|

|

| Policies/energy |

|

|

| Markets/raw materials |

|

|

| Physical risks |

|

|

Risks and Opportunities

| Impacts | Risks | Opportunities | Actions |

|---|---|---|---|

| Markets | [Seal Products]

[Electronic Components]

|

[Group-wide]

|

[Group-wide]

[Seal Products]

[Electronic Components]

|

| Raw materials | [Group-wide]

|

[Group-wide]

|

[Group-wide]

|

| Carbon price | [Group-wide]

|

[Group-wide]

|

[Group-wide]

|

| Energy | [Group-wide]

|

[Group-wide]

|

[Group-wide]

|

| Corporate reputation | [Group-wide]

|

[Group-wide]

|

[Group-wide]

|

| Disasters | [Group-wide]

|

― | [Group-wide]

|

Targets

As part of our climate change actions, the NOK Group has formulated the NOK Twin Green Plan 2030, and has been promoting the reduction of CO2 emissions and development of next-generation eco-technologies. In order to strengthen our climate change actions, we have recently raised the CO2 emission reduction targets set in the NOK Twin Green Plan 2030 based on results from our TCFD scenario analyses. With the aim of achieving carbon neutrality by 2050, we will continue to promote efforts to address climate change and consider revisions to our targets from time to time based on the results of scenario analyses and social conditions.

[Targets]

- 2050: Carbon neutrality target year

- 2030: Reduce NOK consolidated domestic CO2 emissions by 50%(compared to 2018)

Reduce NOK consolidated overseas CO2 emission intensity by 30%(compared to 2018)

As of May 31, 2022